History of Content and MarTech Vendors via Subway Maps

Since 2008 Real Story Group has been mapping the landscape of digital technology vendors that we evaluate in our research streams. Perhaps now, in the midst of a pandemic, is a good time to look at what's changed over the past twelve years, and what patterns or even truths have endured through good times and bad...

Here are some lessons learned via a tour of how RSG's "subway maps" evolved over time.

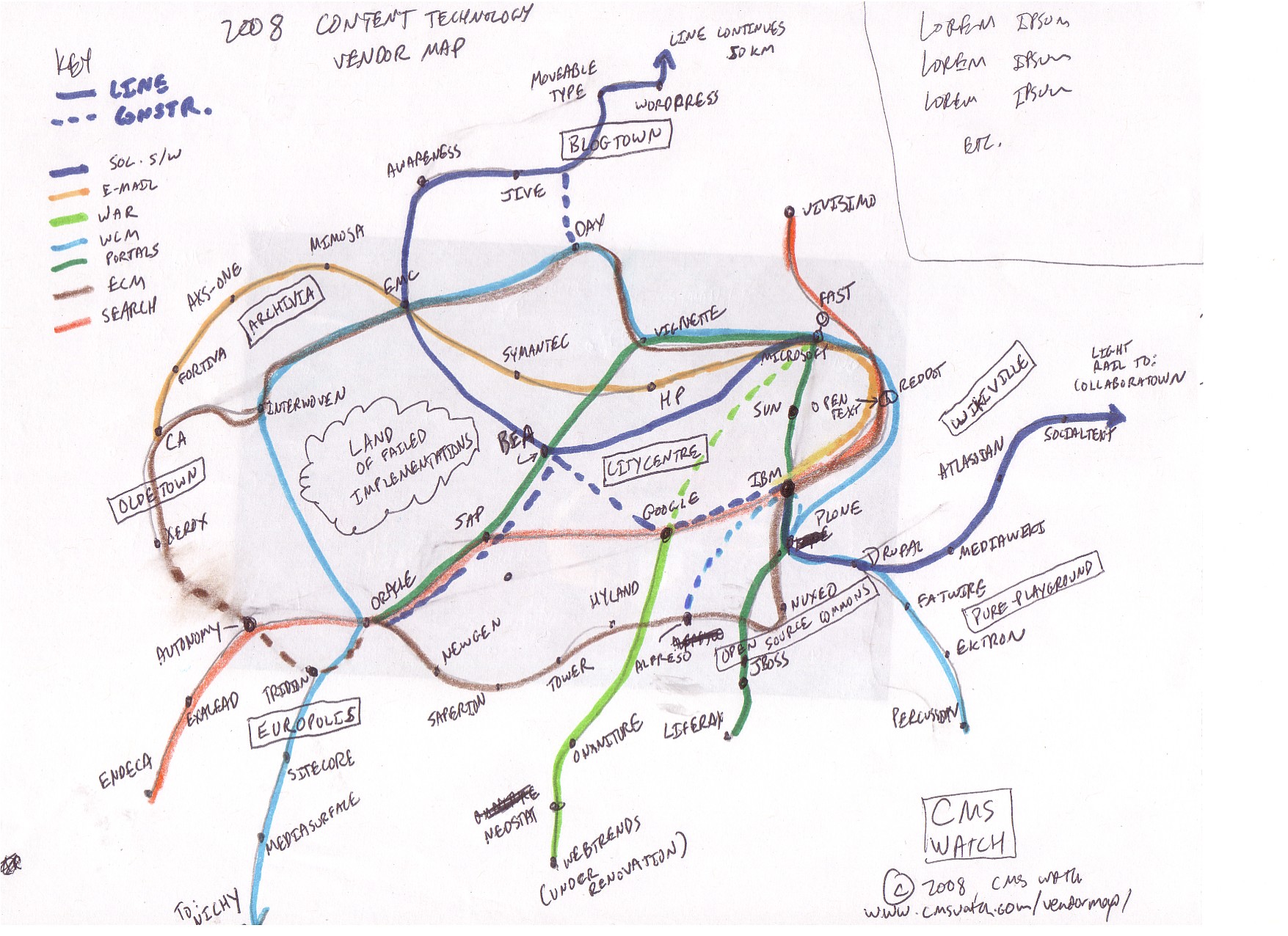

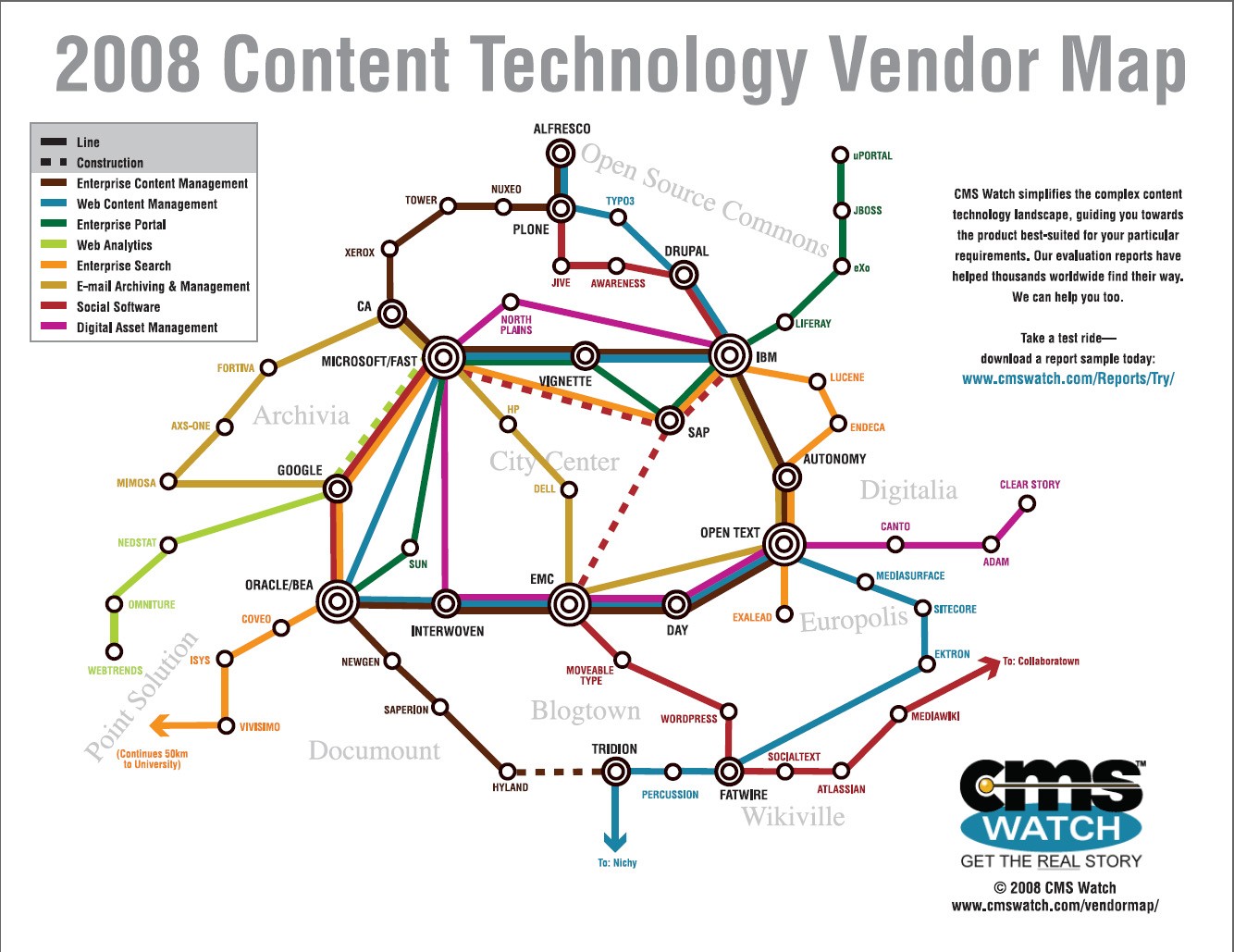

2008

The first subway map emerged quite literally from my kitchen table, back when RSG was still known as "CMS Watch." After expanding our coverage from Web CMS platforms to include Web Analytics, ECM, Search, Portals, DAM, and more, I was trying to organize all the vendors we evaluated into a single diagram that would show relationships and differences among them. The goal was to show which vendors supplied what sorts of technology — and just as importantly, what they did not do. I found a piece of scrap paper and some colored markers.

I was relieved to see that indeed the subway motif would work. Notably, we had to include dotted lines for station connections "under construction." It was more common then for large vendors to say they were "working on" some future technology, mostly to convince gullible analyst firms (and nervous channel partners) that the vendor wouldn't get swamped by the many, many upstart competitors emerging across these marketplaces.

There were few enough vendors then that we could group and label them into neighborhoods. My favorite region from the graphic above was "Land of Failed Implementations" betwixt some of the largest vendors on the map. Already we were seeing that heavy, expensive implementations using platforms from big-name vendors suffered the highest failure rates.

Our excellent graphic designer (Karen Donohue) spiffed up the map and here was the first official version, circa late 2008.

One pattern emerged that persists to this day: large vendors in the city center who sell multiple solutions, as distinguished from a wide variety of pure-play vendors out in the periphery. Where do you think most of the innovation would come from in the subsequent years?

The other trend that year was large vendors (Microsoft, EMC, IBM, SAP) all trying to make a play in Social Software — but all those stations still remained "under construction."

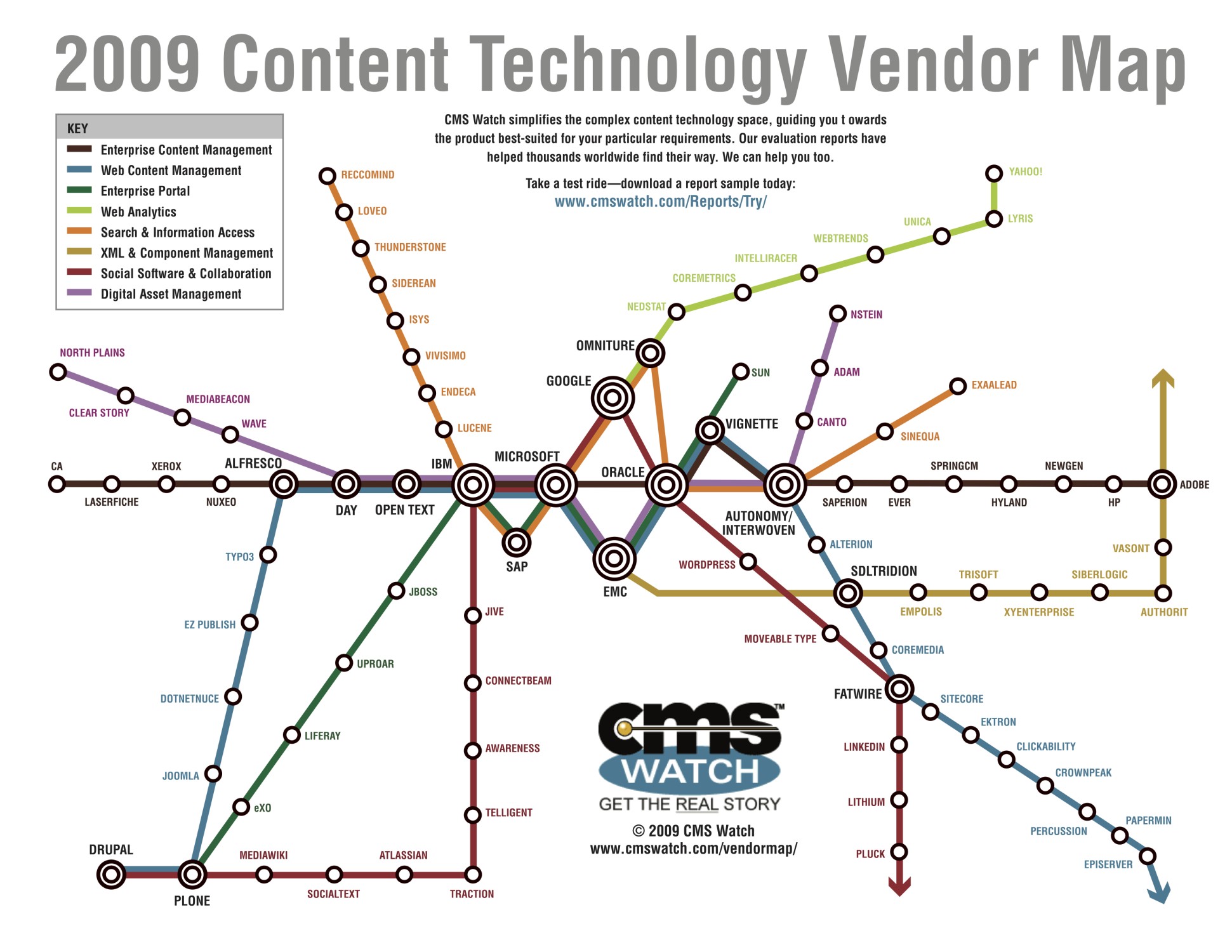

2009

2009 found us dropping Email Archiving (became an oligopoly — and also: boring), and adding a new marketplace, "XML & Component Content Management." The idea for this new line was that structured content would rule the world in an era of information explosion along with greater mobile access. It didn't turn out that way, and all the vendors on the beige line who came into the world explicitly to support product documentation pretty much ended up at the same place they started. But it was heady times...

The red line — expanded to "Social Software & Collaboration" — got longer and would elongate even more before the decade closed. Also, "Enterprise Search" got hot, and a plethora of venture-fueled firms emerged. Investors generally did not fare well there. Search is hard.

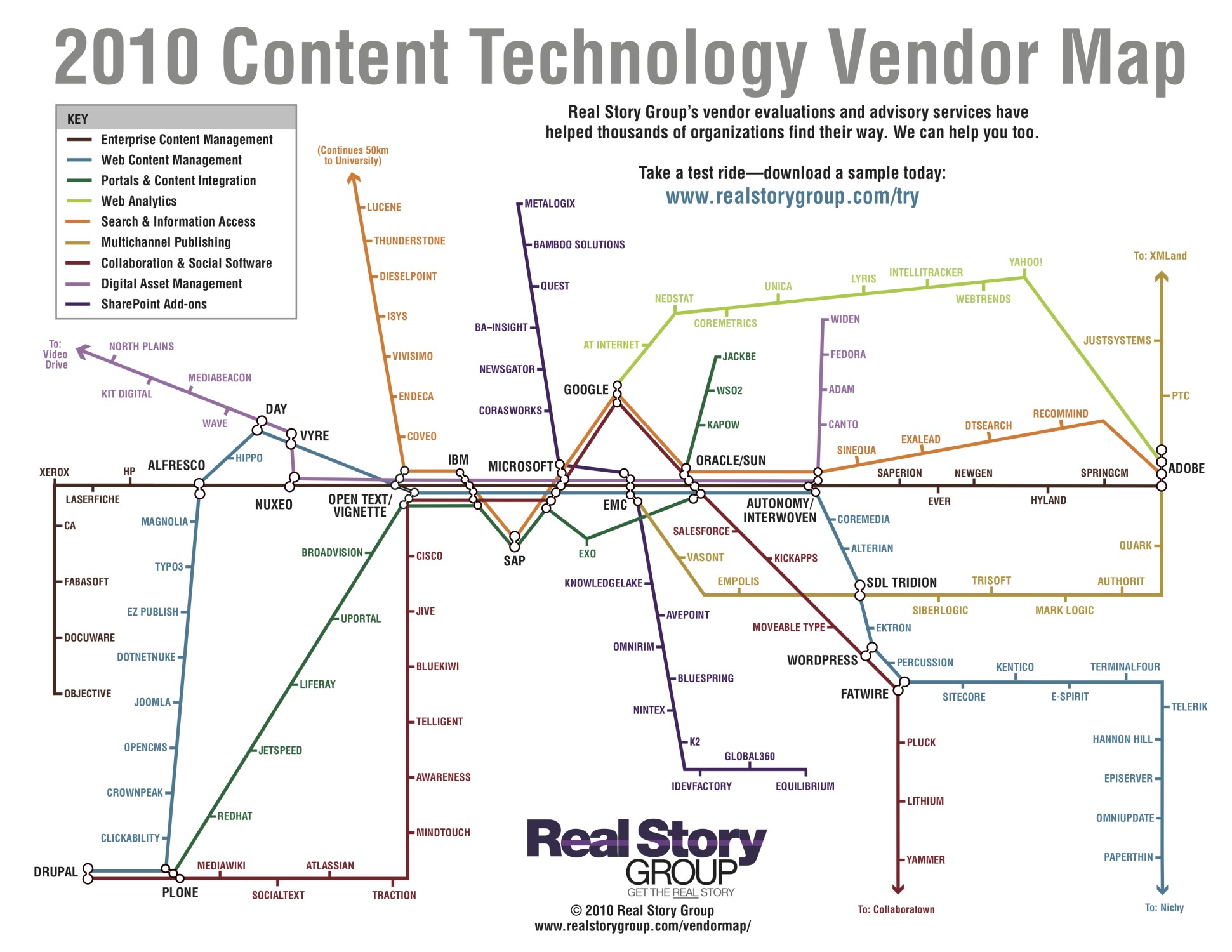

2010

The start of a new decade led to a new company name, and coverage of a lot more vendors, so we had to modify the map motif a bit to make them all fit. Turns out the London "tube map" model worked pretty well.

The recent recession had fueled a plethora of mergers, with dot-com darlings get snapped up on the cheap: Interwoven to Autonomy, Vignette to Open Text, Sun to Oracle, and Omniture to Adobe, now a major player on the right side of the map. The new mega-vendors told enterprise customers they could do it all via "integrated suites." What a joke! Gartner and Forrester advised enterprise digital leaders to find a single "strategic partner" as a safe bet. Web and Marketing teams who couldn't counter with a more modern story about digital engagement ended up suffering a lot under legacy platforms from stodgy vendors. Anyone remember Documentum Web Publisher? Sad.

SharePoint 2010 also burst onto the landscape and would forever change the world of workplace digital. Microsoft pitched SharePoint to business execs as a finished product, but marketed it to IT leaders as an infinitely extensible platform. That contradiction would generate much heartburn upon every triennial SharePoint upgrade, but these were still heady times. SharePoint become such a centrifugal force that we started evaluating its "add-on" vendor ecosystem as RSG's new purple line. The fact that many of these vendors still do a thriving business in the era of SharePoint Online should give Office 365 licensees real pause about total cost of ownership...

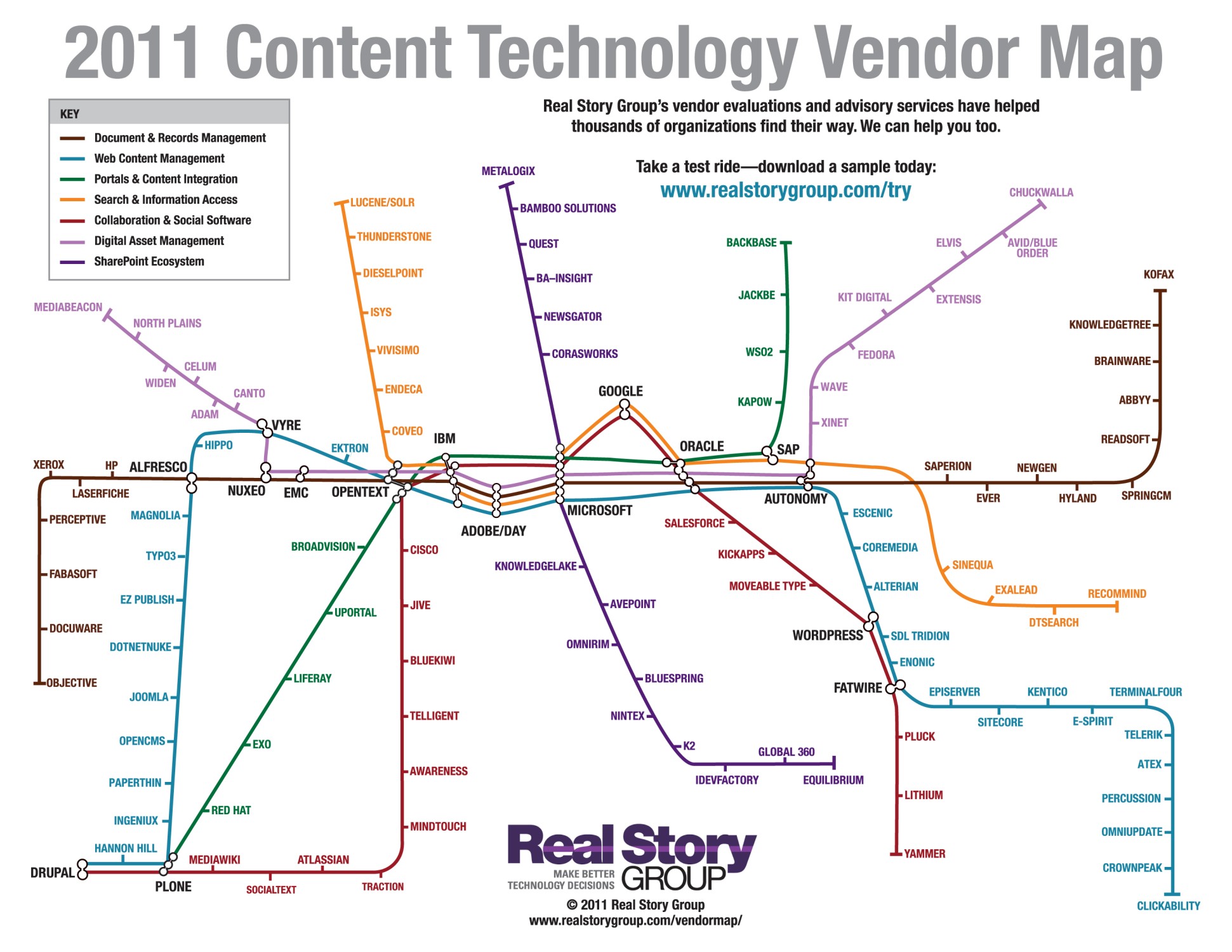

2011

2011 appeared to be a year of great absorption, with OpenText spreading its wings and Adobe moving the center of the map after its acquisition of Day Software.

By this time RSG was covering nearly three-dozen Web Content & Experience Management (WCM) vendors. Interestingly, the marketplace had matured — it was 15 years old by now — but never consolidated. It remains fragmented in 2020, with the vast majority of the players on the blue line still chugging today. RSG's most recent WCM vendor evaluation research finds vendors employing a variety of strategies to differentiate from competitors. As an enterprise customer you have a lot of good choices but need to work a bit to find the right match.

Noteworthy in 2011 was the expansion of the brown line, as grand visions of "ECM" faded a bit and a variety of players emerged or re-emerged to provide more workaday document and records management.

This year we also discontinued Web Analytics (quasi-monopoly with Google and a bit of Adobe) and Component Content Management. To be sure, structured content management is making a comeback again, though mostly under the guise of asset management — more about that when we get to 2019. Still some history to cover first...

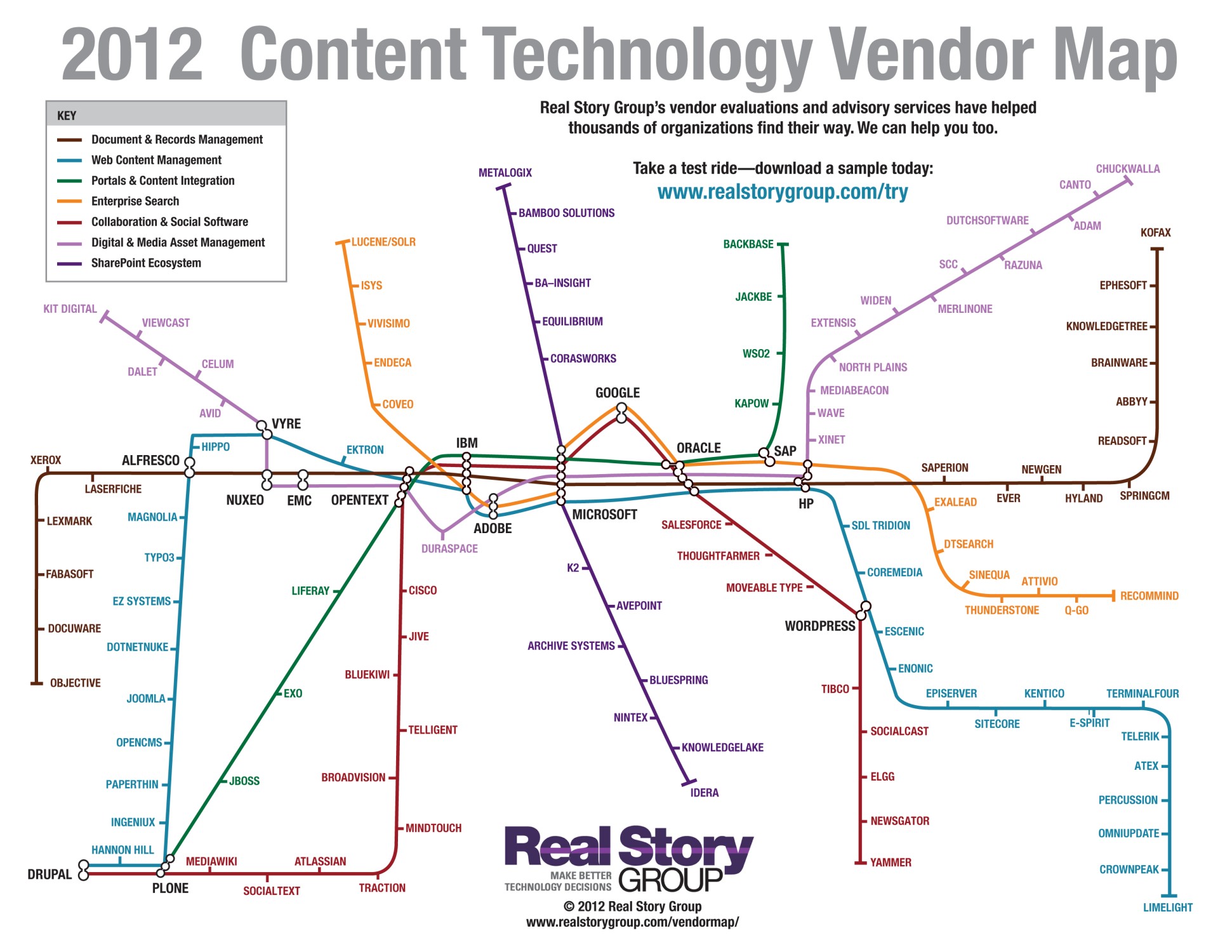

2012

For RSG, 2012 was the year of Digital Asset Management. The long-awaited "DAM wave" hit and we expanded our vendor coverage substantially over the next several years. Some vendors on the pink line never made it to adulthood, but no matter: DAM was here to stay. Because what is marketing without storytelling, and what is storytelling without visuals? DAM became an essential service in your digital marketing stack and as usual, the biggest vendors were pretty bad at it. The DAM marketplace remains highly vibrant and fragmented today, though it's evolving rapidly as well.

2013

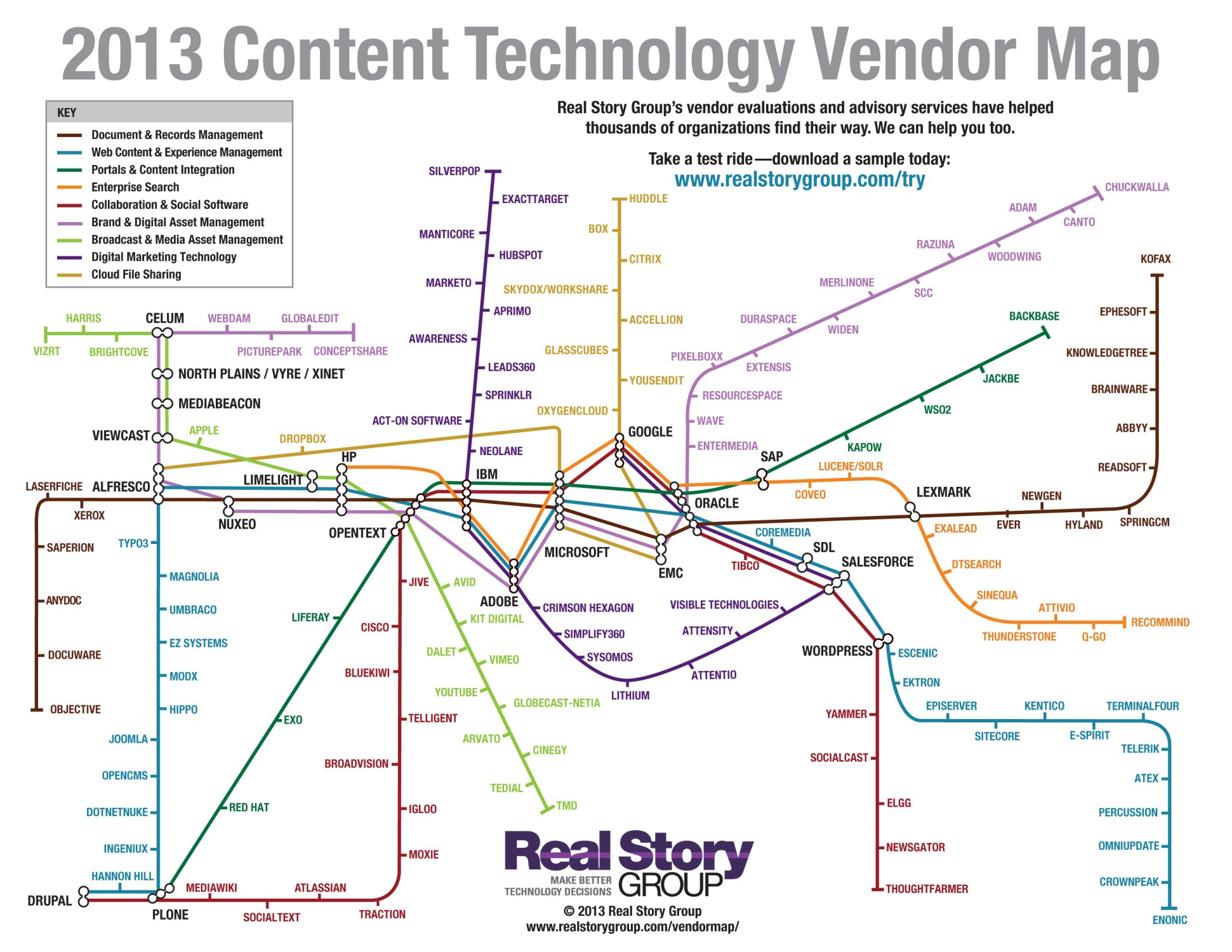

This was a year of great change at RSG, as we started covering three new technology marketplaces. HP also makes a brief appearance, after getting hoodwinked into buying the bones of Autonomy.

First, we added the lime green "Broadcast & Media Asset Management" market. Our thinking was that enterprises would slowly migrate their visual marketing from still images to video, and would require specialized management platforms heretofore limited to broadcast and media companies. This never really happened. Video is specialized, expensive, and tends not to get produced in-house, though this may change. Supporting short-form video remains an important use case for traditional DAM vendors, yet few of them excel at it today.

We also created a new beige line for "Cloud File Sharing" vendors. These were a plucky set of upstarts who revealed that simple file-sharing represented the most common document management use case. They caught all the ECM vendors (including Microsoft) flat-footed. Significantly, they also showed the value of creating native cloud platforms. As would our next category of vendors....

The new purple line represented what RSG called "Digital Marketing Technology" vendors, but were really email and social media management services (a.k.a., "outbound marketing"). Social media was particularly interesting because, depending on the platform, it could cover social publishing, social listening, social CRM, and social intelligence. We predicted a kind of convergence of outreach services that never happened, though most email marketing platforms today can also do some level of social posting as well.

2014

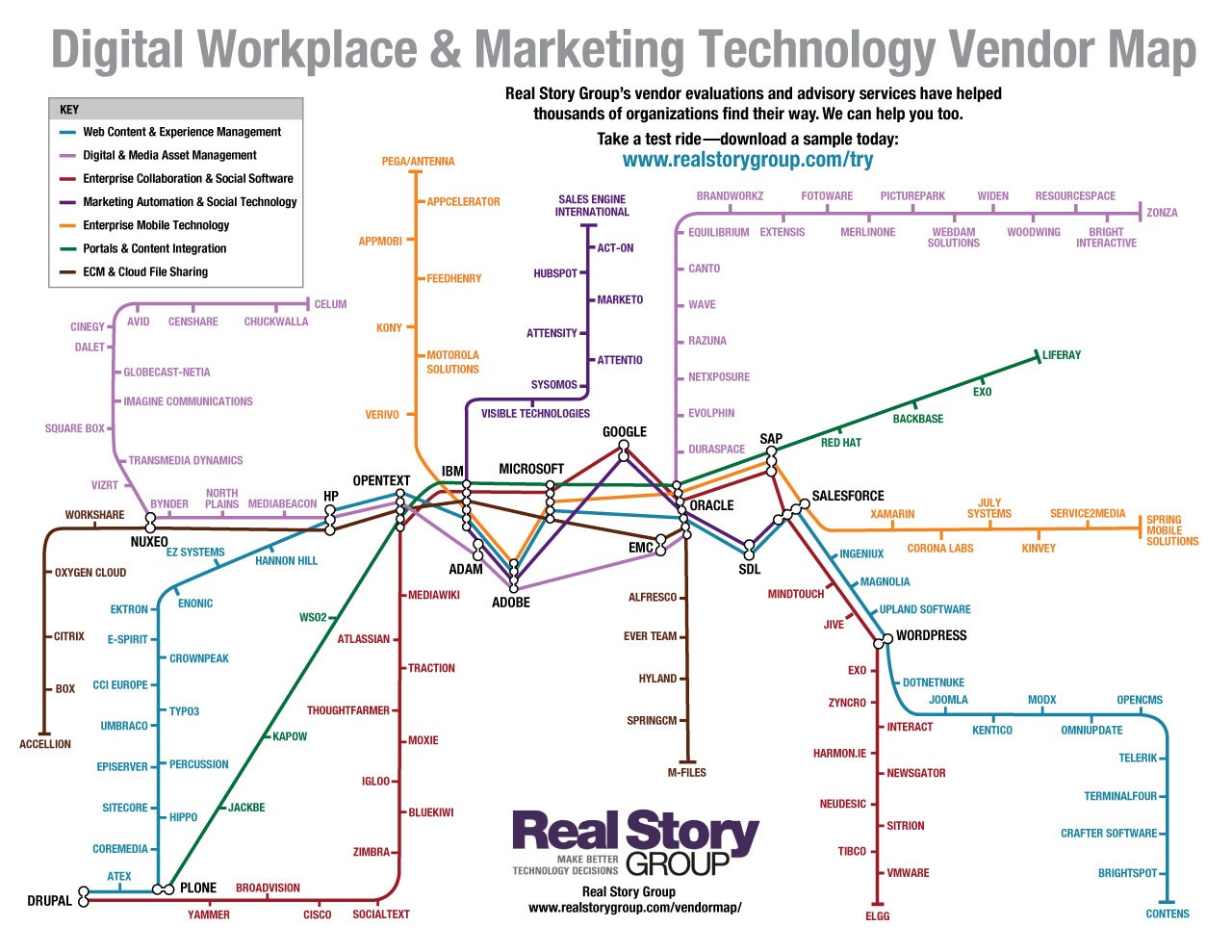

By late 2014 we had already folded Cloud File Sharing into the ECM line since the boundaries between the two got very blurry, very fast. We also deprecated the Broadcast Management line.

Mobile was of course expanding in importance each year, and so we included a new line for "Enterprise Mobile Technology." This was a kind of amalgamation of mobile app development platforms and mobile middleware services — both very interesting, but neither destined to become especially vibrant marketplaces where enterprises would issue serious RFPs.

This year also saw major changes on the purple line as major players like Oracle, Adobe, and IBM snapped up several smaller MarTech vendors. So did Salesforce, which came to occupy a major stop just outside the city center.

2015

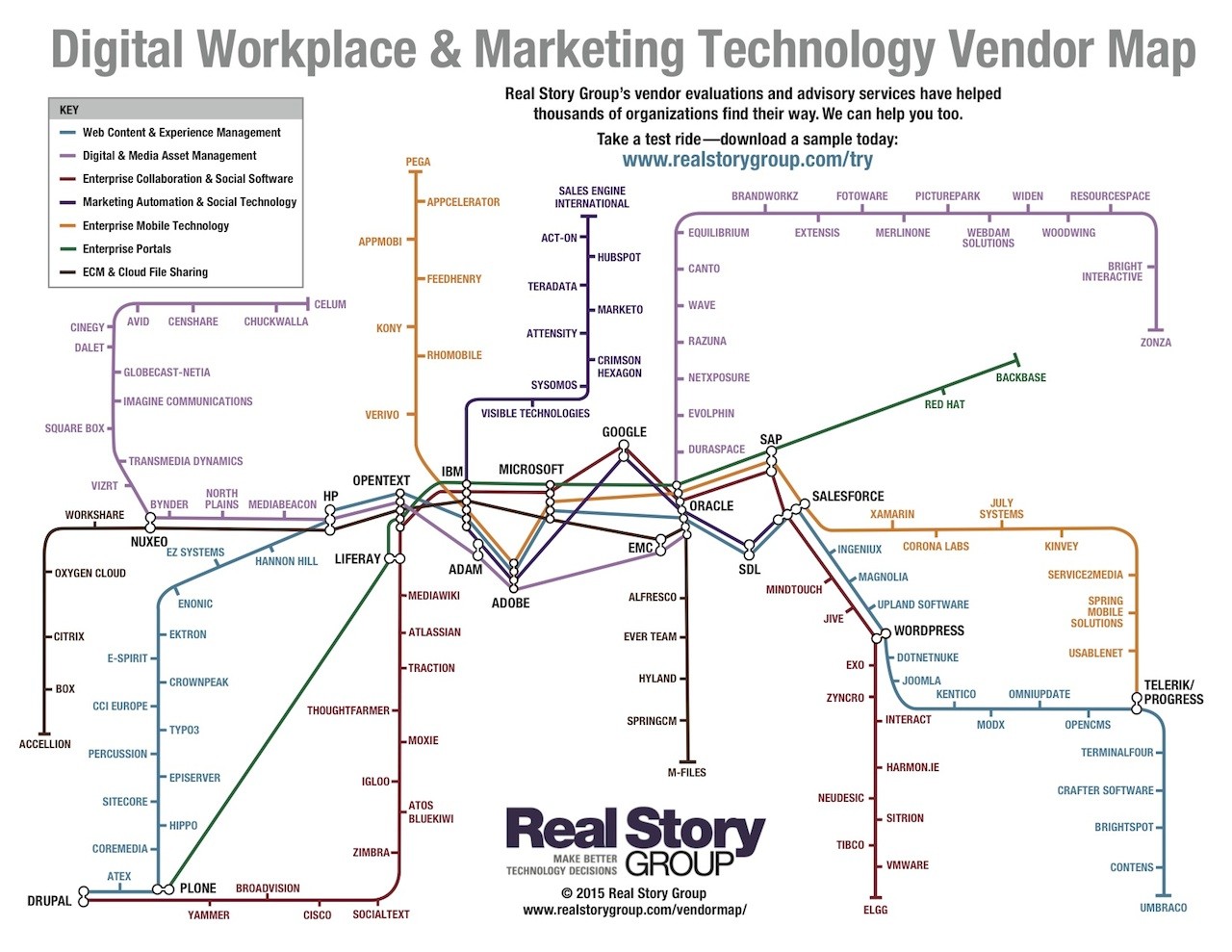

2015 did not bring a lot of structural changes, but some interesting trends emerged. First, it represented the apogee of the red line — essentially the peak of enterprise interest in workplace social and collaboration toolsets before Jive collapsed and Yammer plus Office 365 swamped the market.

This year also saw a major expansion of DAM coverage, along with a significant contraction of Enterprise Portal (green line) vendors. The set of use cases for justifying heavyweight Portal technology continued to shrink.

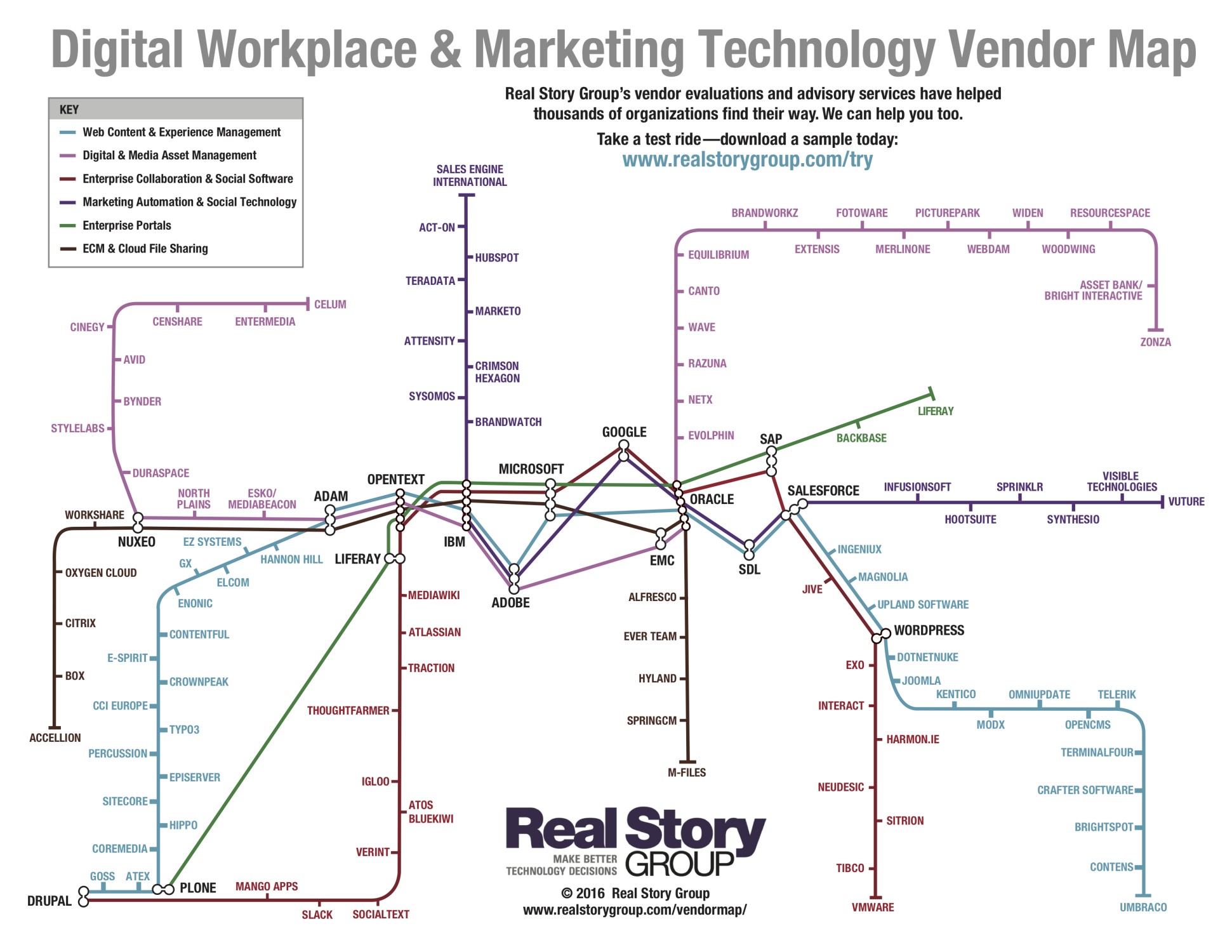

2016

2016 was mostly a year of consolidation, with various tuck-in acquisitions and HP disappearing from this universe (bequeathing tools to EMC and OpenText). Google's footprint also got lighter — at least in this context.

This year RSG also dropped our mobile technology line. It seems obvious in retrospect that mobile-enablement would become a feature and not an end in itself, but today we see that pattern recurring with AI, ML, Blockchain, and other new approaches to old problems. Your focus should lie on customer and employee enablement; artificial intelligence may or may not fulfill your objectives here. Savvy digital leaders distinguish between means and ends.

On the WCM line, we started to cover more headless and cloud-native vendors, including Contentful.

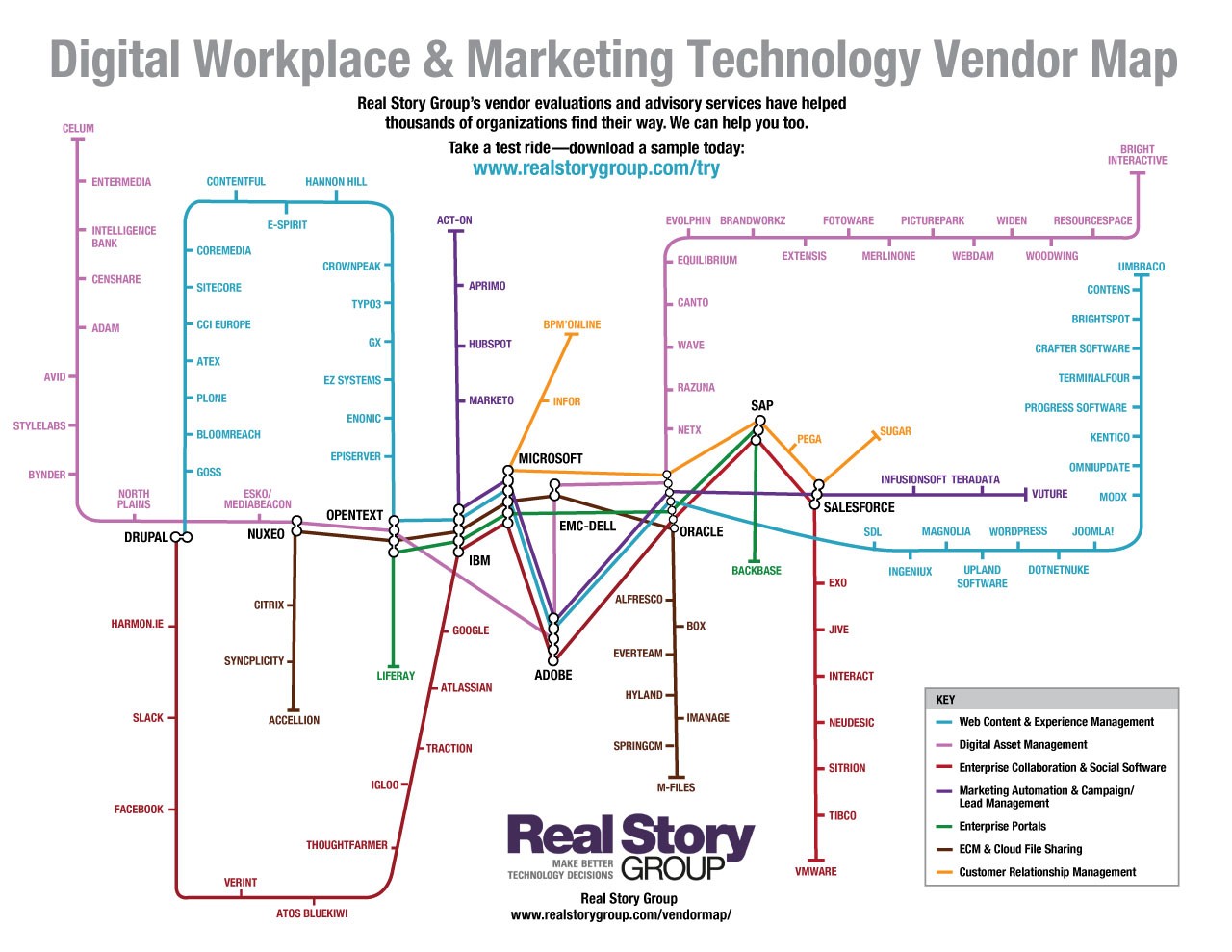

2017

2017 featured even more expansion in the DAM marketplace, along with a bit of contraction among document and records management vendors.

This year RSG started covering the CRM market (orange line). It's a mature marketplace but many of our subscribers urged us to perform vendor evaluations, since they were considering switching providers. One interesting tidbit about CRM is that the top eight dedicated vendors command less than 50% marketshare. Many enterprises still obtain CRM-like services from a huge set of more generic business management systems.

This is as good a time as any to explain how vendors make it onto this map. In short, it's because we evaluate that solution as part of a marketplace research stream. Vendors often ask how they can get included. It's simple. RSG's enterprise subscribers ask us to cover someone. This sometimes confuses vendors who are used to paying analyst firms for exposure — or at least attention. Unique in the analyst industry, RSG only works for you, the enterprise technology buyer. That's why our vendor evaluations are the toughest you'll find — but always fair.

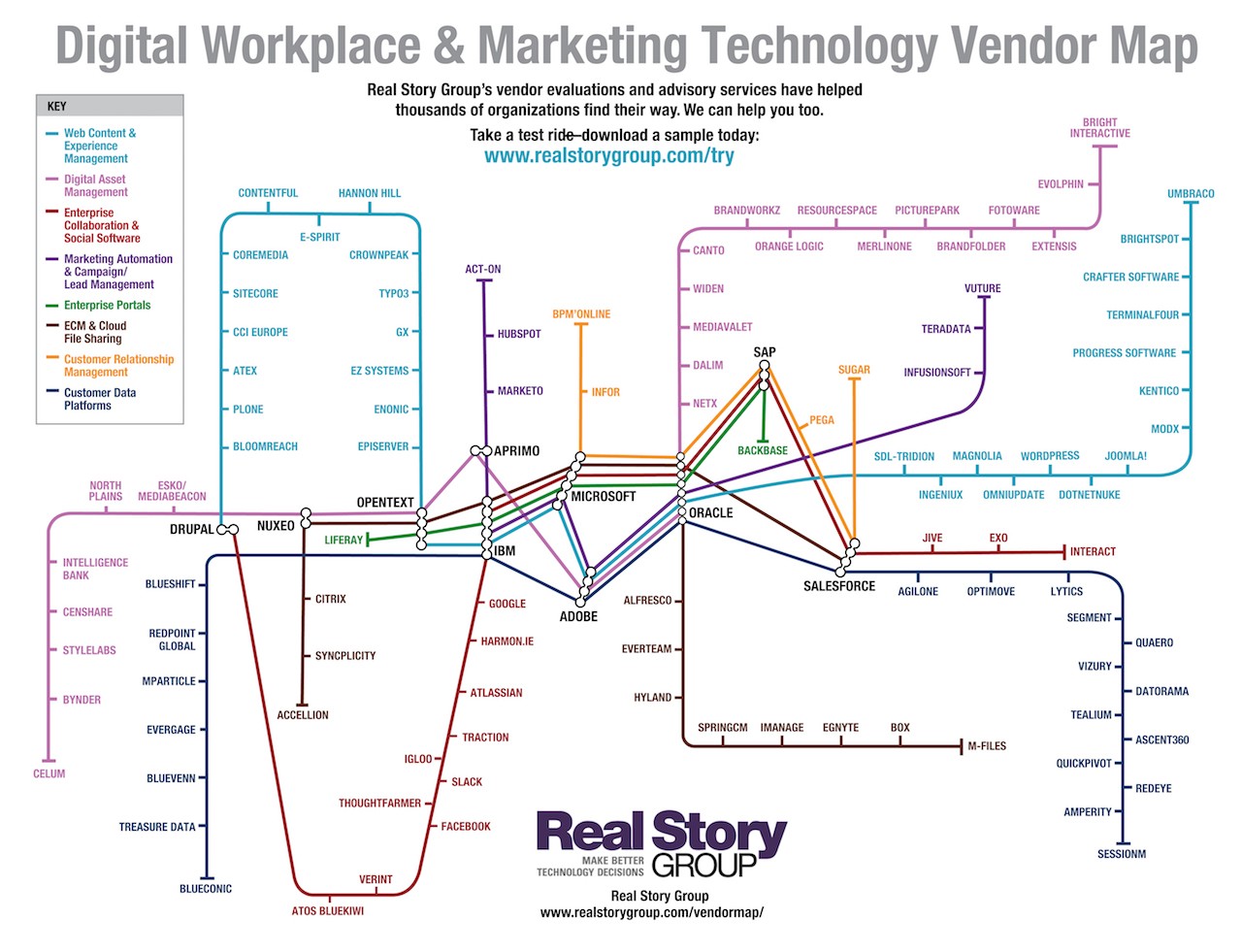

2018

2018 saw continued contraction among Enterprise Collaboration & Social Software vendors, presaging an eventual collapse of the market as a whole.

The big news for 2018, though, was the formal arrival — with a bang! — of the Customer Data Platform (CDP) marketplace. The market had been building for a few years, but really came of age in 2018. We started out of the gate evaluating two-dozen CDP vendors (and have added many more since), a record for RSG in starting new marketplace coverage.

You could argue that CDPs are overhyped, and I won't disagree, but the rapid rise of interest in this technology hinted at a something bigger happening in MarTech stacks. In a world of omnichannel customer touchpoints, you could no longer afford to "trap" customer data in isolated engagement silos. Yet couldn't you make the same argument about decisioning, orchestration, personalization, and re-usable content? Shouldn't those services also get liberated from channel-specific silos? The close of the decade began to herald a new world for digital.

With dozens of CDP vendor choices, how do you chose among them? We've long argued that instead of looking for the "best" vendor cited in traditional, static analyst quadrants, you should find the best-fit vendor, based on your unique circumstances. In 2018 we finalized "RealQuadrant," a decision-support tool and shortlist builder for RSG subscribers. We also published a book about applying more modern, design-thinking principles to the process of technology selection.

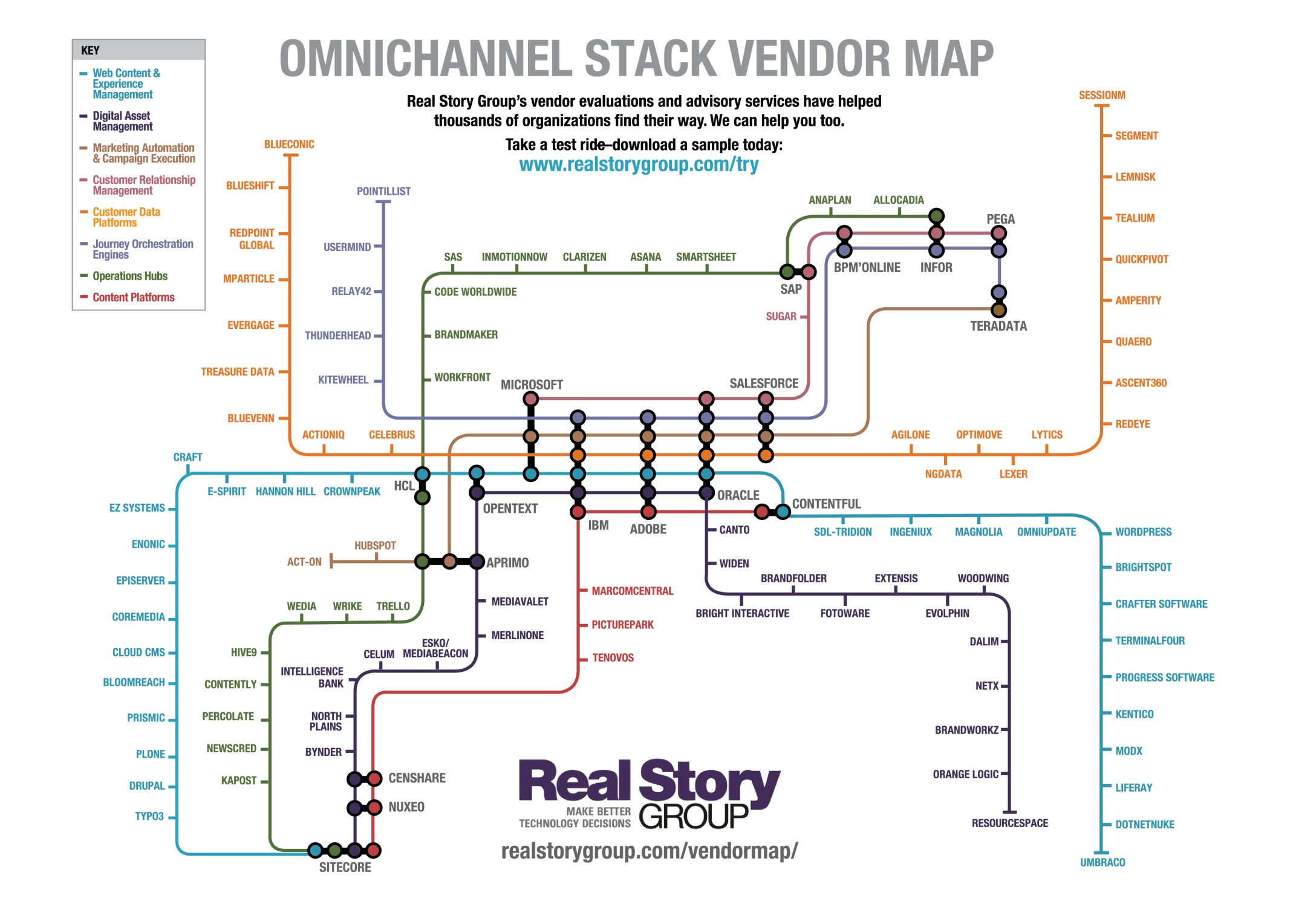

2019

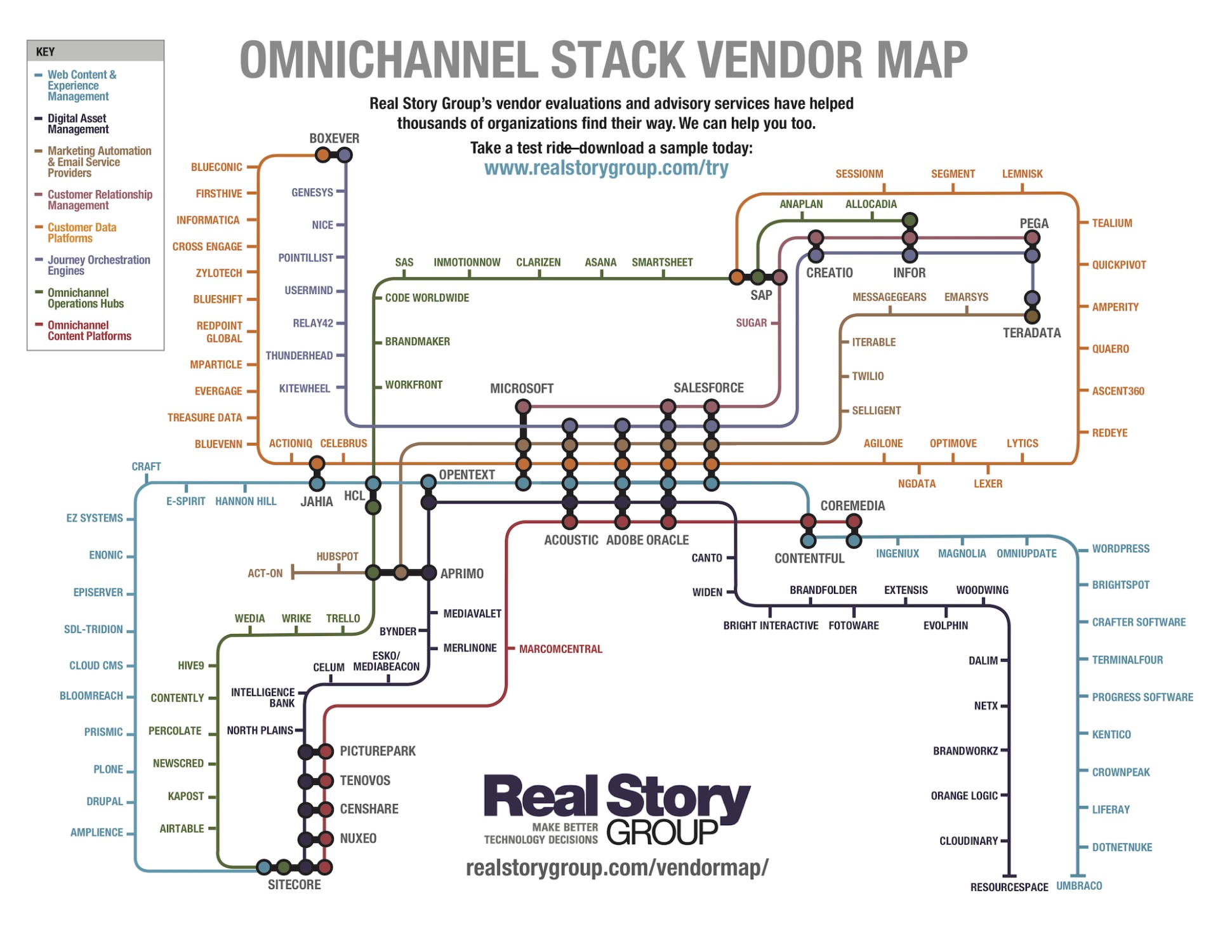

This was the year we re-thought the entire landscape for digital. A deepening focus among RSG's enterprise subscriber base around truly customer-centric digital engagement started to lead to a convergence between traditionally separate MarTech and customer experience (CX) interests. A new omnichannel stack is beginning to emerge, with channel-agnostic "foundation services" provided by not just Customer Data Platforms (orange), but also Journey Orchestration Engines (lavender), Omnichannel Content Platforms (red), and Omnichannel Operations Hubs (green).

This led us to a profusion of subway lines and vendors, necessitating the first interface tweaks in nearly a decade.

To be sure, "older" digital platforms like WCM and CRM still matter, though we now argue you should now start thinking about simplifying your investments in these channels. At your behest, this year RSG started covering more "headless" WCM vendors, though this architectural model has probably peaked.

The close of the decade brings a caution... Much like 2010 found traditional analyst firms urging a return to the 2000s via "ECM Suites," 2019 saw analyst firms doubling down on the 2010s by counseling you to invest in mythical "DXPs." Don't do this. It's a vendor fantasy, but a career-deadener for you the enterprise digital leader.

2020

In 2020 RSG covers more vendors than ever before. Enterprise stack leaders are showing renewed interest around intelligent email-based engagement, and many of you are looking to transition from customer journey mapping to customer journey orchestration. That's a big leap for sure, but a growing market of "JOE" vendors awaits you.

Of course, the marketplaces continue to evolve. IBM exited this world completely, bequeathing toolsets to HCL and Acoustic. Microsoft showed a bit more MarTech life by rolling out a CDP, but is otherwise really just a bit player in the new omnichannel stack. Many of you now license both Adobe and Salesforce platforms and struggle mightily to integrate the two. Building out a stronger core underneath both vendors could help.

What's Next?

I can't say exactly what the 2021 map will look like. RSG has created an exclusive leadership council of enterprise stack owners and they are starting to shape our research agenda going forward. Last year collaboration and integration were top of mind for them. This year our second meeting focused on MarTech funding, Marketing Ops, and CDP maturity, among other topics.

If there was a single enduring theme of the past twelve years of map-making it's fragmentation. Despite the rise of mega-vendors and maturing marketplaces, the latest map suggests you have many, many vendor choices. We consistently see more market entry than market exit. How long will this persist? I don't know. I do know that across two decades of watching digital marketplaces, I've seen a lot more supplier expansion than consolidation.

As you look to make the right tech stack decisions going forward, turn to advisors who have one eye on the past and one eye on the future. Please reach out to explore how RSG can make your team more successful in the coming decade.

What trends went missing here? Feel free to share this post on LinkedIn or Twitter to add your own perspective...